Gayatri Solution Group

Good News Gayatri Solution Group Create Android App Download Chick Here Server 1, Server 2, Server 3,

Gayatri Solution Group Solar Products

File GSTR-3B and Make Payments

In Tally.ERP 9, you can export data in the JSON format

and upload it to the portal for filing the returns.

File GSTR-3B

Ensure that all exceptions regarding incomplete/mismatch

in information are resolved before printing or exporting the GSTR-3B

report. File GSTR-3B in either of the

following methods:

Method 1: By Generating the JSON file from Tally.ERP 9

To generate GSTR-3B returns in the JSON format

1. Go to

Gateway of Tally > Display

> Statutory Reports > GST > GSTR-3B.

2. F2: Period - select the period for

which returns need to be filed.

3. Press

Ctrl+E.

4. Select

JSON (Data Interchange) as the Format.

5. Press

Enter to export.

Note:

If you have made purchases attracting reverse charge from registered dealers

outside the state, enter the values mentioned below in the JSON file:

♦ In 3.1.d

of JSON file, under "isup_rev":

{ enter the taxable amount in "txval"

and integrated tax amount in "iamt".

♦ In 4 a 3

of JSON file, under "ty": "ISRC",

enter the integrated tax amount in "iamt".

For further details, refer to calculating integrated

tax on reverse charge purchases from registered dealers.

Upload the JSON file to the portal for filing returns.

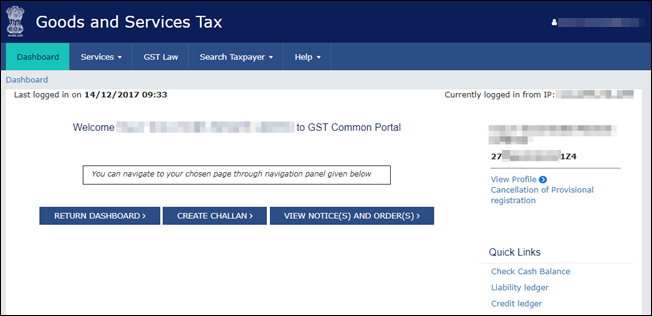

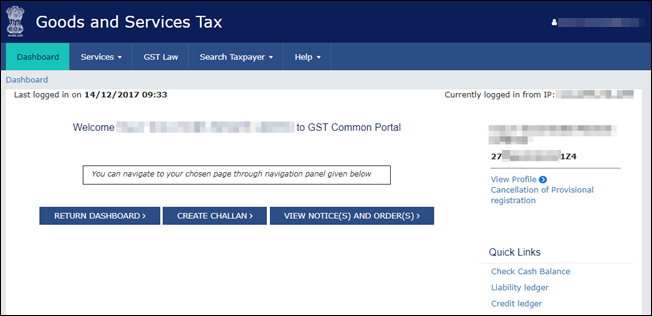

1. Log in

to the GST

portal.

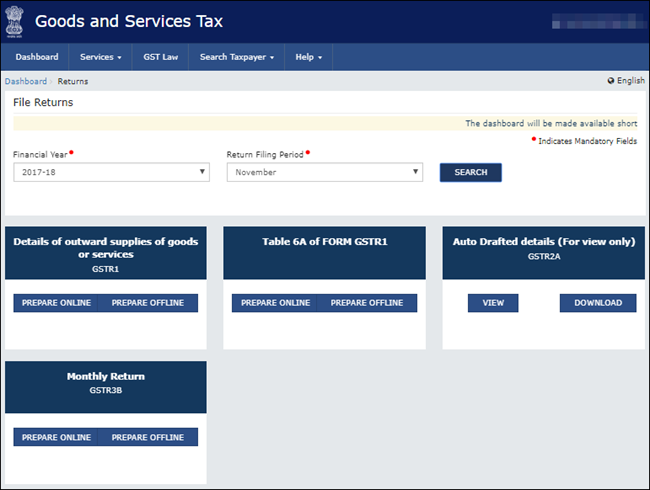

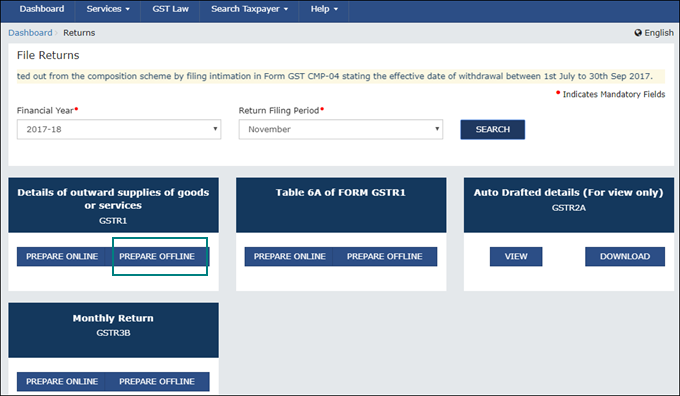

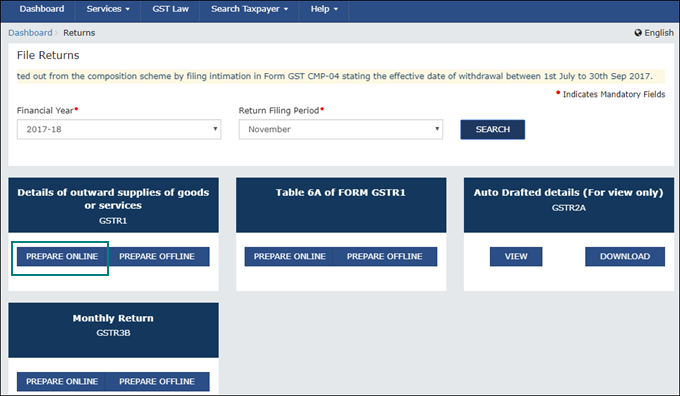

2. Go to

Dashboard > RETURN

DASHBOARD.

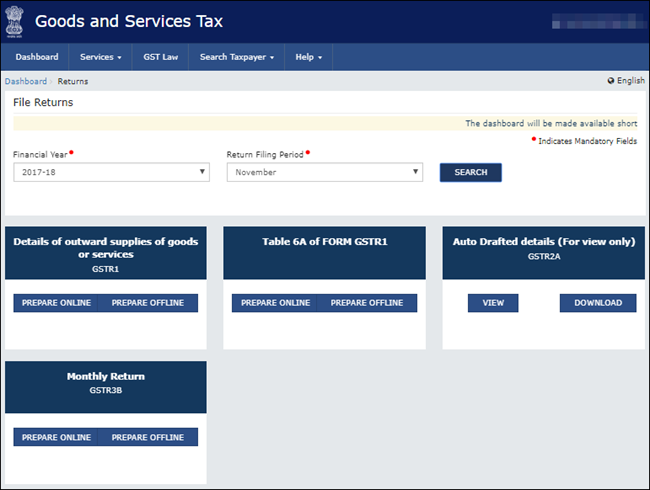

3. Select

the Return Filing Period, and

click Search.

4. Under

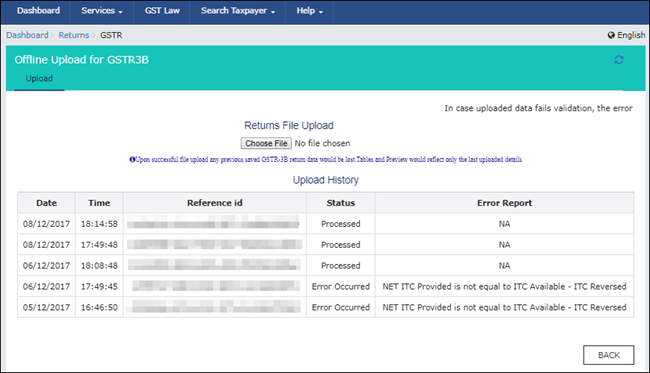

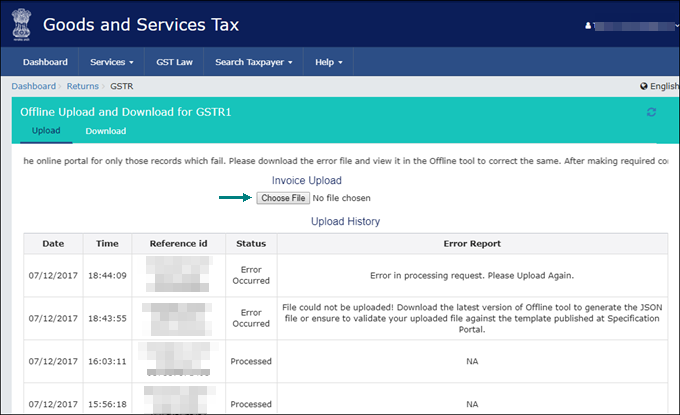

Monthly Return GSTR3B, click PREPARE OFFLINE > UPLOAD tab > click CHOOSE

FILE to import the GSTR-3B JSON file generated from Tally.ERP 9.

Once your JSON files are uploaded successfully, you will be notified with

a message. Once the file is successfully uploaded the Error

Report displays NA.

5. Click

BACK > Monthly

Return GSTR3B, click PREPARE ONLINE.

The values get posted in the relevant tables of GSTR-3B.

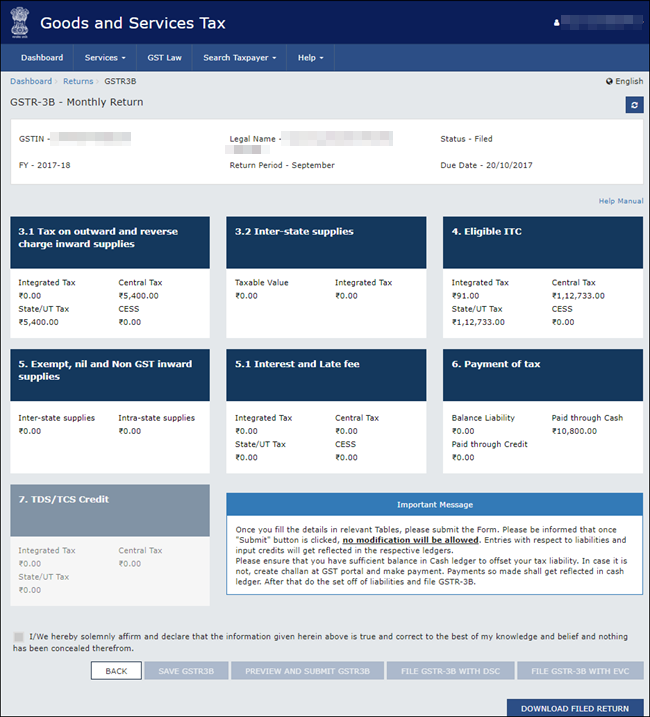

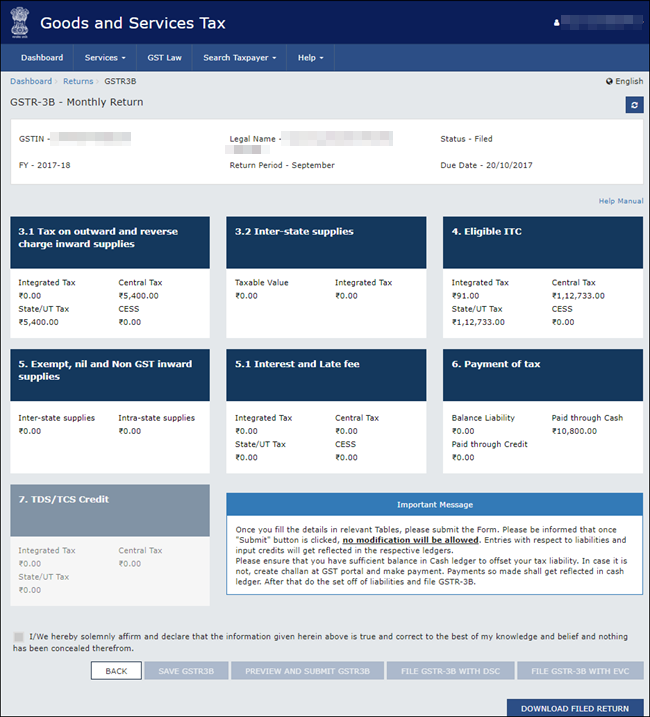

6. Click

the declaration check box and click SAVE

GSTR3B.

7. Make

payments towards GSTR-3B to file your GSTR-3B returns.

8. Click

PREVIEW AND SUBMIT GSTR3B to submit

GSTR-3B returns.

9. Click

FILE GSTR-3B WITH DSC or FILE GSTR-3B WITH EVC based on the

mode you prefer to sign the returns.

Note: Once you

click the Submit button, GSTR-3B

cannot be revised.

Method 2: By using the GSTR3B Excel Offline Utility Tool

To download the tool

1. Go to

the GST portal.

2. Click

Downloads > Offline

Tools > GSTR3B Offline Utility.

3. Click

Download.

4. Click

PROCEED. A .zip file containing the GST

Excel Utility will be downloaded. Some important information about

the tool, and the system requirements for using the tool are also available

on the download

page.

5. Extract

the file GSTR3B_Excel_Utility_V3.0.xlsm

from the .zip file and copy it to the location where Tally.ERP

9 is installed.

To export GSTR-3B returns to the MS Excel template

1. Go to

Gateway of Tally > Display

> Statutory Reports > GST > GSTR-3B.

Note: Ensure to

use a fresh template each time before exporting the GSTR-3B data.

2. F2: Period - Select the period for

which returns need to be filed.

3. Press

Ctrl+E.

4. Select

Excel (Spreadsheet) as the Format. If the template GSTR3B_Excel_Utility_V3.0.xlsm

is not available in the Export

Location, the message appears as shown:

5. Ensure

the template GSTR3B_Excel_Utility_V3.0.xlsm

is available in the Export Location.

Press Enter to export the data.

The Microsoft Excel template opens with the data updated

in the relevant fields.

Note:

If you have made purchases attracting reverse charge from registered dealers

outside the state, refer to calculating integrated

tax on reverse charge purchases from registered dealers.

6. In the

template:

● Click Validate to view the status of the

sheet.

● Click Generate File. The JSON file gets

generated in the folder GSTR on the desktop.

7. Upload

this JSON file on the GST portal. Click here

for the procedure of submitting and filing GSTR-3B.

Note: If the status

is Validation Failed, correct

the errors mentioned in the template, and then click Validate.

For more details on the information captured in each

column of the e-return template, click here.

Method 3: By filing your returns directly on the GST portal

To print GSTR-3B

1. Go to

Gateway of Tally > Display

> Statutory Reports > GST > GSTR-3B.

2. Press

Ctrl+P to print the form.

Note: Ensure the

MS Word application is available in your computer to view the form.

3. In the

Print Report screen, press Enter. GSTR-3B is created in the

word format.

4. Press

Ctrl+S to save the word file.

You can print the word file and use the hard copy

to fill information online or directly copy and paste the values from

the MS Word file to the online form.

To file GSTR-3B

1. Log

in to the GST

portal.

2. Go to

Dashboard >

RETURN DASHBOARD.

3. Under

Monthly Return GSTR-3B, click

PREPARE ONLINE.

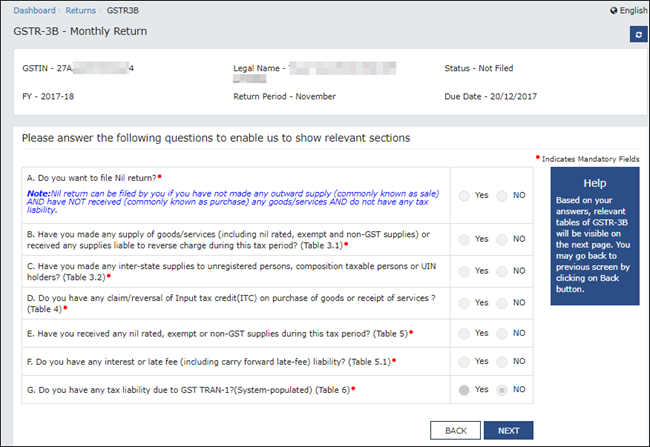

4. Select

the required options in the GSTR-3B dashboard to view the relevant sections

of GSTR-3B in the next screen. Click NEXT

to proceed.

5. Click

each table and manually fill the details by referring to the GSTR-3B printed

from Tally.ERP 9 in the MS Word format. Click CONFIRM in

each table after providing the details.

6. Click

the declaration check box and click SAVE

GSTR3B.

7. Make

payments towards GSTR-3B to file your GSTR-3B returns.

8. Click PREVIEW AND SUBMIT GSTR3B to submit

GSTR-3B returns.

9. Click

FILE GSTR-3B WITH DSC or FILE GSTR-3B WITH EVC based on the

mode you prefer to sign the returns.

Note: Once you

click the Submit button, GSTR-3B

cannot be revised.

Integrated tax on reverse charge purchases from registered dealers

If you have made purchases attracting reverse charge

from registered dealers outside the state, you need to manually enter

the integrated tax amount in the JSON or MS Excel file generated from

Tally.ERP 9 before filing your returns.

To identify the values and enter it in the JSON or

MS Excel file

1. Go to

Gateway of Tally > Display

> Statutory Reports > GST > GSTR-3B.

2. Under

Reverse Charge Liability to be booked,

press Enter on Reverse

Charge Inward Supplies.

3. Click

E: Export from Purchase

of Reverse Charge Supplies – Reverse Charge Liability report.

4. Select

the Format as Excel

(Spreadsheet), and export the data.

5. Filter

for all the transactions on which Integrated

Tax has been charged, and arrive at the total tax amount.

6. Manually

add this tax amount to the value of Table 3.1

d. Inward Supplies (liable to reverse charge) and 4A

(3) Inward supplies liable to reverse charge (other than 1 & 2 above)

in the data exported in JSON or MS Excel format from Tally.ERP 9.

Making Payments towards GSTR-3B

After successfully filing GSTR-3B, you can easily

make payments to GST by creating a challan. The GST ITC amount will be

updated in the credit ledger in the GST portal, and will be carried forward

to the subsequent month.

To match the GST amount payable with your books of

accounts, you can adjust the GST liability with the tax credit. Refer

to Recording

Journal Vouchers for Adjustments Against Tax Credit under GST for

the procedure to record the transaction.

If the above example is taken, GST payable is as shown

below:

To make payments towards GSTR-3B

1. Log in

to the GST

portal.

2. Go to

Services > Payments

> Create Challan.

3. Under

Tax Liability, enter the required

values.

4. Under

Payment Modes, select the required

method of payment. If you have chosen NEFT/RTGS as the mode of payment,

you also have to select your preferred Remitting

Bank.

5. Click

GENERATE CHALLAN.

The Beneficiary Details

appear according to the Remitting Bank

selected.

6. Click

DOWNLOAD to generate the challan.

Using this challan, you can make the payment through net banking or cash/cheque

payment in the bank. When you complete the payment, money gets transferred

to your e-Cash ledger.

Note: If the tax

amount is less than Rs. 10,000 you can make cash payment in the bank with

the challan.

7. Log in

to the GST portal and make the tax payment.

8. After

the payment, submit your GSTR-3B returns.

This completes your GSTR-3B filing.

Source :-https://help.tallysolutions.com/article/te9rel63/Tax_India/gst/filing_gstr3b.htm

File GSTR-1

With Tally.ERP 9, you can file GSTR-1 in three easy ways:

by generating JSON from Tally.ERP 9, by using the GST Offline tool, or

by filing directly on the GST portal. Watch our video on this page to

learn more.

GSTR-1 includes the details of all outward supplies

made in a given period.

File GSTR-1 in either

of the following three methods:

Prerequisites for

filing GSTR-1

● Internet connectivity:

This is required for uploading the JSON file, downloading the offline

tool, and filing returns.

● Microsoft Office:

For exporting data to MS Excel, GSTN recommends MS Excel 2007 or later

(if you are using the GST Offline Tool and MS Excel for filing returns).

Tax liability on advance

receipts

● For businesses

with an annual turnover of up to Rs. 1.5 crores, there is no need to pay

tax on advance receipts from customers. To support this, the calculation

of tax liability on advance receipts has been disabled by default from

Release 6.1.1.

● The values of

tax liabilities on advance receipt from customers will not be included

in the GSTR-1 returns by default. Such transactions will appear under Not relevant for returns in the

GSTR-1 report.

● For businesses

with turnovers above Rs. 1.5 crores, you can enable the option Enable

tax liability on advance receipts in the Company

GST Details screen.

Method 1: By generating JSON from Tally.ERP 9

Generate GSTR-1 returns in the JSON format

1. Go to

Gateway of Tally > Display

> Statutory Reports > GST > GSTR-1.

2. F2: Period: Select the period for

which returns need to be filed.

3. F12: Configure: To view the export

options for HSN/SAC details, enable Show

HSN/SAC Summary?

4. Press

Ctrl+E.

● Select JSON (Data Interchange) as the Format.

● Export

HSN/SAC details even if UQC is not available? - Yes,

to export transactions where UQCs are not available. For such transactions,

you have to map the units of measurement of the stock items to related

UQCs in the MS Excel or CSV file. For more details, click here.

● Export

HSN/SAC details not included for other reasons? - Yes,

to export transactions that are not included in the HSN/SAC

Summary due to various reasons. You have to enter this data directly

on the portal.

Note: The options

Export HSN/SAC details even if UQC is

not available? and Export HSN/SAC

details not included for other reasons? will appear only when

the option Show HSN/SAC Summary?

is set to Yes in the GSTR-1

report.

If the data is exported without enabling the option

Show HSN/SAC summary? in

the configuration screen of the GSTR-1

report, the HSN summary of the exported output file will be blank.

● Allow

Export of:

o All

Vouchers: Select this option to export all the transactions that

have been already filed on the GST portal.

o Only

New Vouchers: Select this option to export the transactions that

are not filed on GSTN portal.

5. Press

Enter to export.

Compress the JSON file generated from Tally.ERP 9

in the .zip format and upload

it to the portal for filing returns.

1. Click

Ctrl+O from GSTR-1

report.

2. Log in

to the GST portal.

3. Click

Services > Returns

> Returns Dashboard.

4. Select

the Return Filing Period, and

click Search.

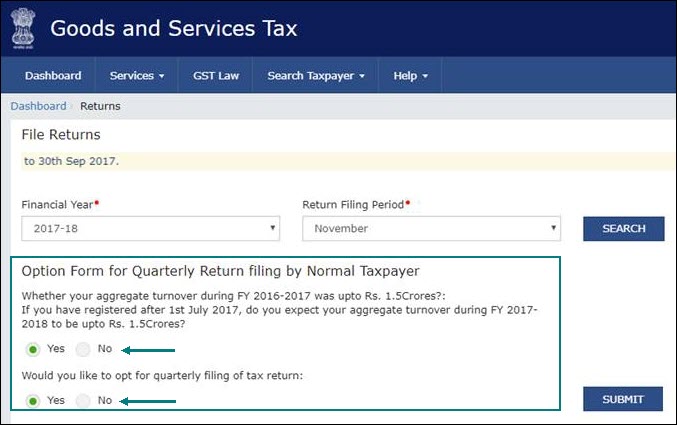

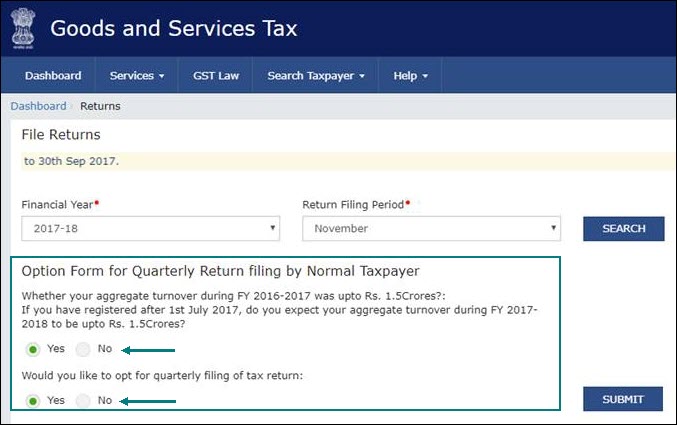

5. Select

Yes or No

based on your turnover to file Monthly

or Quarterly returns. If you want

to opt for quarterly returns, then set the 2nd option to Yes.

6. Click

SUBMIT.

7. Click

PREPARE OFFLINE.

8. Click

Choose File to import the JSON

file generated from Tally.ERP 9 or the offline tool.

Once your JSON file is uploaded successfully, you

will be notified by a message.

9. Verify

the uploaded details after the time specified in the GSTR

screen.

You have to manually enter the details for Nil

Rated Supplies and Documents Issued

by referring to the table-wise format of GSTR-1,

because these details do not get directly uploaded to the portal.

10. Go to

Services > Returns

> Returns Dashboard,

and click Prepare Online.

11. Go to

the 8A, 8B, 8C, 8D - Nil Rated Supplies

page, and enter the details.

12. Go to

the 13 - Documents Issued page,

and enter the details.

13. Submit

your returns and e-sign.

Method 2: By using the GST Offline Tool

Export GSTR-1 returns in the MS Excel or CSV

1. Go to

Gateway of Tally > Display

> Statutory Reports > GST > GSTR-1.

2. F2: Period: Select the period for

which returns need to be filed.

3. F12: Configure: To view the export

options for HSN/SAC details, enable Show

HSN/SAC Summary?

4. Press

Ctrl+E.

● Select Excel (Spreadsheet) or CSV

(Comma delimited) as the Format.

● Export

HSN/SAC details even if UQC is not available? - Yes,

to export transactions where UQCs are not available. For such transactions,

you have to map the units of measurement of the stock items to related

UQCs in the MS Excel or CSV file. For more details, click here.

● Export

HSN/SAC details not included for other reasons? - Yes,

to export transactions that are not included in the HSN/SAC

Summary due to various reasons. You have to enter this data directly

on the portal.

● Allow

Export of:

o All

Vouchers: Select this option to export all the transactions that

have been already filed on the GST portal.

o Only

New Vouchers: Select this option to export the transactions that

are not filed on GSTN portal. To avoid overwriting the existing files

with the new transactions, use a different MS Excel file name.

5. Press

Enter to export.

If you have selected the CSV format, Tally.ERP 9 will

create separate CSV files for each table in GSTR-1. These files need to

be imported into the GST Offline Tool.

Note: If $ symbol

appears in the data exported to MS Excel, generate your data in the CSV

format. If you want to continue in the MS Excel format, go to the Trust Center Settings in MS Excel,

and add the location where Tally.ERP 9 is installed on your computer.

Click here for more information.

For information regarding the mapping of unit of measurement

(UOM) when the UQC is not available, click here.

If the error Internal

Error Report GSTR 1 Export File 41194-00004.cap appears, click

here to view

the cause and solution.

For more details on the information captured in each

column of the e-return template, click here.

Import data and generate the JSON file

1. Open the

GST Offline Tool. Ensure that

you download and install the latest version of the GST Offline Tool. Click

here for more details.

2. Click

NEW.

3. Provide

the required details, and click PROCEED.

4. Click

IMPORT FILES.

5. Click

IMPORT EXCEL, and select your

file.

Note: If the tool

shows a warning that some invoices contain invalid input, you can ignore

it and proceed. This happens when you do not have transactions in the

given sections.

To export the return details in the CSV format, select

the name of the table in Select Section

under Return Import – One section at

a time, and click Import CSV.

You have to individually import files for each section.

6. Click

YES on the warning message, and

click VIEW SUMMARY.

7. Click

GENERATE FILE.

The offline tool generates a JSON file that has to

be uploaded on the GST portal.

For e-commerce

operators

The GST department has not issued GSTIN/UIN for e-commerce

operators. Currently, when data is exported from Tally.ERP 9 to MS Excel

or CSV files, the GSTIN/UIN entered in the e-commerce party ledger is

captured as E-Commerce GSTIN in

b2b, b2cl,

and b2cs worksheets. After exporting

data to MS Excel or CSV files:

1. Delete

the GSTIN/UIN captured in the column E-Commerce

GSTIN.

2. Set the Type as OE

in the b2cs worksheet.

3. Generate

the JSON file.

Method 3: By filing your returns directly on the GST portal

1. Log

in to the GST

portal.

2. Select

the Return Filing Period, and

click Search.

3. Select

Yes or No

based on your turnover to file Monthly

or Quarterly returns. If you want

to opt for quarterly returns, then set the 2nd option to Yes.

4. Click

SUBMIT.

5. Click

PREPARE ONLINE.

6. Open each

GSTR-1 table, read or copy data from Tally.ERP 9, and fill the tables.

7. Submit

your returns and e-sign.

Download and Install the GST Offline Tool

2. Click

Returns Offline Tool. A .zip file containing the GST

Offline Tool will be downloaded. This zip file also contains a

detailed document on using the offline tool. Some important information

about the tool, and the system requirements for using the tool are also

available on the download

page.

3. Extract

the offline tool from the .zip file and install it.

Installing the latest version of the GST Offline Tool

If you are using an older version of the GST

Offline Tool, you have to uninstall it and install the latest version.

Uninstall the GST

Offline Tool

1. On your

computer, go to Control Panel

> Programs and Features.

2. Right

click GST Offline Tool, and click

Uninstall and proceed.

3. Similarly,

uninstall the Node.js application.

4. Delete

the installation folder of the older version.

5. Restart

your computer. Now you can download and install

the latest version of the GST Offline

Tool.

Note: You can use

the GST Offline Tool either on the same computer where Tally.ERP 9 runs,

or on a different computer.

Mapping the unit of measurement (UOM) when the UQC is not available

The list of Unit Quantity Code (UQC) provided by the

department does not have the representative code for brass, carats, litres,

running foot, and so on. To handle this situation:

1. Based

on your business requirement, map the unit to the related UQC and export

it to MS Excel or CSV files. For example, you can map litres to KLR-KILOLITRE.

2. In the

hsn worksheet of the template

or CSV file, convert the quantity as per the mapped UQC. For example,

if litre is mapped to KLR-KILOLITRE, multiply the quantity by 0.001 in

the hsn worksheet of the template

or CSV file to convert litre to kilolitre.

3. Upload

the modified MS Excel template or CSV file to the GST Offline tool.

4. Generate

the JSON file.

Examples of mapping units to the related UQCs with

the conversion factors are given below:

Unit of Measure

|

Nearest UQC

|

Conversion of Quantity in Template

|

Litres

|

KLR-KILOLITRE

|

Multiply by 0.001

|

MLT-MILILITRE

|

Multiply by 1000

|

|

Carat

|

KGS-KILOGRAMS

|

Multiply by 0.0002

|

GMS-GRAMMES

|

Multiply by 0.2

|

|

Brass

|

SQF-SQUARE FEET

|

Multiply by 100

|

CBM-CUBIC METERS

|

Multiply by 2.835

|

|

Running foot

|

MTR-METERS

|

Multiply by 0.3048

|

Cubic inches

|

MLT-MILILITRE

|

Multiply by 16.3871

|

Hanks

|

YDS-YARDS

|

For cotton, multiply by

840

|

For woolen, multiply by

560

|

||

Inches

|

MTR-METERS

|

Multiply by 0.0254

|

CMS-CENTIMETERS

|

Multiply by 2.54

|

|

Pounds

|

TON-TONNES

|

Multiply by 0.000453592

|

KGS-KILOGRAMS

|

Multiply by 0.453592

|

|

GMS-GRAMMES

|

Multiply by 453.592

|

|

Lots

|

TON-TONNES

|

Multiply by 0.0000128

|

KGS-KILOGRAMS

|

Multiply by 0.0128

|

|

GMS-GRAMMES

|

Multiply by 12.8

|

|

Milligrams

|

GMS-GRAMMES

|

Multiply by 0.001

|

Decameter square

|

SQY-SQUARE YARDS

|

Multiply by 119.599

|

SQF-SQUARE FEET

|

Multiply by 1076.39

|

|

Square inches

|

SQM-SQUARE METERS

|

Multiply by 0.00064516

|

SQY-SQUARE YARDS

|

Multiply by 0.000771605

|

|

SQF-SQUARE FEET

|

Multiply by 0.00694444

|

|

Tola

|

GMS-GRAMMES

|

Multiply by 11.6638125

|

Note: The e-Return

file has the provision to capture the taxable value and tax rate but not

the tax amount. Hence, the tax amount is not exported to the e-Return

file. The tax value is automatically calculated after upload to the portal

based on rate, taxable value, and place of supply.

Source :-https://help.tallysolutions.com/article/te9rel63/Tax_India/gst/filing_gstr1.htm

Tally.ERP 9 Release 6.3.1

The latest version under Tally.ERP 9 Release 6 series is Release 6.3.1, launched on 26th December, 2017.

We have made some enhancements to further improve your GSTR-1 and GSTR-3B filing experience.

Below are the key enhancements of Tally.ERP 9 Release 6.

Export GSTR-3B in JSON format

Below are the key enhancements of Tally.ERP 9 Release 6.

Export GSTR-3B in JSON format

- You can now directly export GSTR-3B form in JSON format and upload it to the GST portal. If you prefer to view the GSTR-3B in MS Excel before uploading, you can do so as well. Download the GSTR-3B Offline Utility from the GST portal. Tally.ERP 9 exports details of the transactions into the GSTR-3B MS Excel form. Click on Validatebutton in the form. Upon successful validation, you can generate the form in JSON and upload it to the portal.

- Make your customers happier by printing invoices with complete item-wise and rate-wise tax breakup details. You can see tax details (CGST, IGST, SGST, Cess) individually for each line item. Press F12 > Enable Print Item-wise GST details. Tally.ERP 9 automatically changes the print setting to Landscape.

- As per the announcements made in the 23rd GST Council Meeting, regular dealers with turnover less than 1.5 Cr have to file GSTR-1 on a quarterly basis. As soon as this feature is enabled in the GST portal, you can generate your quarterly GSTR-1 return.

In Gateway of Tally, F11 > F3 > Statutory details. Choose: Set/alter GST details. A new option, Periodicity of GSTR-1 is available. Select Quarterly here.

- Tally.ERP 9 has enhanced the GSTR-3B return with a new inclusion of Table 5.1 Interest and Late Fees Payable. You can record details of any interest or late fees that you might have to pay here and keep your books updated.

To buy or upgrade, visit https://tallysolutions.com/gst/

Read our blog post on Why to upgrade Tally.ERP 9 to the latest version?

Read our Release Notes to know about other improvements in Release 6.3.1

Click here to check if you can upgrade to this release

Source :-https://tallysolutions.com/download/

CLICK HERE TO SHOW PRICE LIST

CLICK HERE TO GET GSG YOUR CITY PARTNER

CLICK HERE TO GET GSG YOUR CITY PARTNER

More Detail E Way Bill Click Here

CLICK HERE TO DOWNLOAD

Customization in Tally.ERP9

1000+ Ready to use add-ons or customize your Tally on your own way.

- Sms Module Agent Module Security Features Contact Manager Inventory Report

- Auto Email Outstanding Followup Half Page Invoice Voucher Aurthorization

- Serial Member Search Textile Industries Ginig Mills Petrol Pumps Iron & Steel

- Mobile Application

Mobile Tally - Tally Mobile Application

Dashboard Daily Sales Report Daily Purchase Report Cash & Bank Stock Summary Bills Receivable Billy Payable Fix Assets Loans (Liability) Today Daybook Source :- tallyBIZSource :-http://gujaratsamachar.com/, http://www.gujarati.webdunia.com/,

http://www.akilanews.com

Products :-CPU, Motherboard, RAM, HDD, LCD – LED, Keyboard, Mouse, DVD Writer, SMPS, Speaker, Battery, Adapter, Cooling Pad, Screen Guard, Bag, Internet Dongles, Blank CD – DVD, Pen drive, Web Camera, Microphone, Headphone, External CD Drive, Cables, Projector, Scanner, Printer, Education CD - DVD etc…

More Products List Click Here

More Products List Click Here

Note :- Purchase any products just email inquiry.gsg13@gmail.com

Published By :-

Gayatri Solution Group

No comments:

Post a Comment